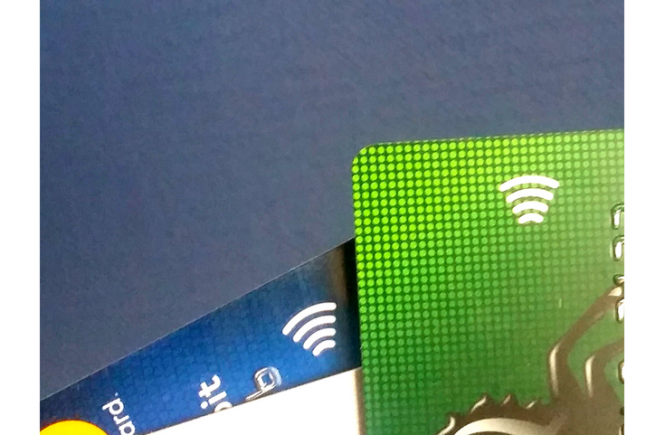

Going contactless: the future of how we pay

More of us are paying by card than ever before. We tap our card at the supermarket, on the bus, and even at church!

According to UK Finance, we used our debit cards 13.2 billion times last year, overtaking cash for the first time. Stats also reveal that 63% of Brits are now using contactless payments, with approximately 3.4 million almost never using cash. This surge in popularity for contactless has come about as the tech involved in this type of payment has become more accessible for consumers.

Contactless payments growing in popularity

Although contactless payments have been around since 2007, there have been some changes in recent years that have made it easier for us to pay this way. The first of these was the introduction of Apple Pay in 2014. This mobile payment option made it easier for people with Apple products such as the Apple Watch and the iPhone to pay for services and products.

2014 was also when TfL rolled out contactless to the tube and other transport options in the capital. Shortly after, we saw more businesses and services across the capital and beyond adding contactless to the available payment options. Consumers found that their banks were actively offering to upgrade debit cards, giving them the option to go cash-free.

The pros and cons of contactless pay

There are benefits to paying this way. By going cashless, consumers can have a faster, more efficient shopping experience. Queues for everyday things like the morning coffee and a round of drinks after work are shorter.

Another positive is that there is no need to carry as much cash. Instead of fumbling around for change or trying to remember our PIN, we can just tap our card onto the card reader and the transaction is complete.

These pros of cashless payments work for cashiers, too. Contactless payments help to reduce the number of people waiting to be served and the need to ensure there is enough change in the till is not quite so significant. Another reason for businesses to introduce contactless is that customers will spend more if they’re using a contactless payment option, such as Apple Pay or a contactless debit card.

Before we join Sweden in becoming an almost-totally cash-free society, however, there are negatives to consider. One of the main concerns is the issue of security. As this technology does not require a PIN, the contactless card can easily be picked up and used by someone else. There is a £30 limit for each transaction, but this has not stopped fraudsters taking advantage when presented with the opportunity.

Another issue is the reliability of the tech being used. Banks have experienced problems lately, with changes to IT systems at TSB causing issues for its customers, and Visa’s technical issues had an impact across Europe and caused cardholders to not be able to access their cash.

Then there’s the question of credit score. People with bad or poor credit ratings have been known to be turned down for contactless cards. This is largely down to whether there are funds in the account to make the transactions. If there is problematic credit there, then issuing a contactless card could become an issue for the bank and cause the customer to go into an unplanned overdraft. Learning how to check your credit score could help you know where you stand.

The elderly often find the transition away from cash to be difficult, as do those who are “unbanked” – without access to bank accounts.

What’s Next?

We’re already seeing the closure of cash machines and as tech changes, we are more likely to see alternative types of contactless tech. Banks like Barclaycard are already investigating using contactless chips in watches, while fingerprint and iris scanning is set to become everyday technology.

While this doesn’t necessarily mean the end for cash completely, it does mean that we are all embracing new ways to pay.

Over to you…

Is this a good or a bad thing? Are you for or against a contactless payment future?