Are you saving enough for your child’s future?

Most parents will give this question a fair bit of thought – it’s impossible to see what the future will bring, but that doesn’t stop us from worrying about it! Worrying doesn’t exactly do any good though, so if you want to give your child a bit of a financial cushion for future events, you’d be better off counting the cost and starting a savings pot.

Investing in a tax-free plan for a child can be a very good idea as there’s naturally an extended period over which to build up that savings pot before it needs to be accessed.

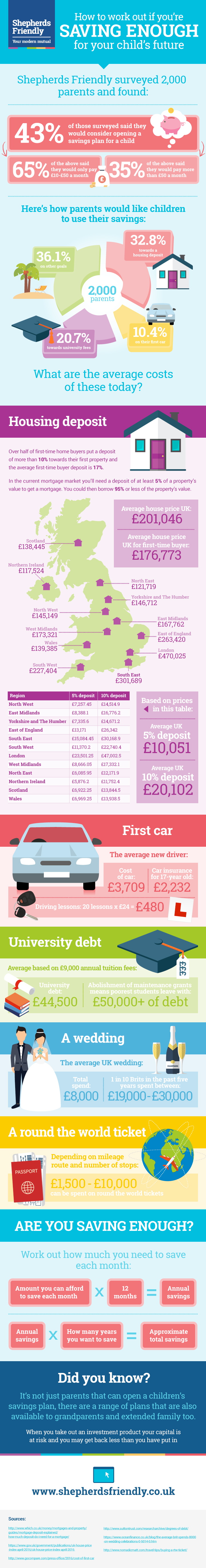

How much do you need to save? That’s a big question, but I’ve found an infographic to share from Shepherds Friendly that shows what other parents are hoping to save for, and how much they might need.

How to work out if you’re saving enough

The data used in the infographic comes from a survey of 2000 parents, who were asked whether they would consider opening a savings plan for a child, and if so, how much they would save each month, as well as what they would want to save up for.

Big-ticket items like a deposit for a first home as well as tuition fees for university feature here, as one would naturally expect. As a parent, you’d probably love to be able to offer a helping hand with major expenses like these, but are you saving enough?

Over to you…

What did you think about the data? Weddings and driving lessons are also big expenses that it would be wise to factor in – driving lessons first, obviously!

In fact, our first goal is to save up for a first car for our son, and for the lessons that he’ll need as well. Oh, and for the crazy insurance costs that come along with it.

What events in your child’s future would you like to save up for?