Curve review – by a real user

I have four credit cards and five debit cards. My husband has two credit cards and four debit cards. I’ve also got a prepaid Mastercard, and occasionally we pick up more of these.

Between us, we run a network of bank accounts that most people would find dizzying. So when I found out about Curve, a Mastercard that combines them all and offers lots of enticing benefits, I was naturally very interested, but I had a couple of questions:

Is it safe?

How much does it cost?

How does it work?

Is it worth it?

Now, I’ve had the chance to try it out, and here are the answers! In short, I do suggest you should get a get a Curve card, and here are 5 reasons why:

5 reasons to get a Curve card

1. Get £5 for signing up

Free money is always going to get a thumbs up from me! Use promo code G68DX when you download the app and you’ll get a free £5. Heads up – you have to use the code to get the cash.

2. Paying with your credit card… when you’re not allowed to

You can get around some sites’ and merchants’ restrictions on paying with a personal credit card, as using your Curve card is, again, a debit card transaction. This means you can pay your tax bill to HMRC with your credit card! Also, if, like me, you’ve regularly paid your council tax and utility bills via credit card for the points, you can get around any restrictions on credit card usage.

I just wish this was around way back when I paid my rent by debit card!

3. Cashback offers

One of my favourite things! You can get 1% cashback at three retailers of your choice with both Curve Blue and Curve Black, and at six retailers of your choice with Curve Metal.

(Find out more about the different cards in the “How much does a Curve card cost” section below)

The cashback on the free card is limited to the first three months, but of course it’s still worth getting. I’ve added Amazon to my list of cashback retailers as Amazon are notoriously hard to find on cashback sites these days, and so far I’ve collected cashback at Tesco as well. More info on the cashback feature in the “Features” section below.

4. Combining cards, transactions and receipts in one place

Don’t underestimate the value of simplifying your finances – you don’t need to have as many cards as us to feel frazzled, and a bit of order can help a lot. You can also have receipts emailed to you, which is also very helpful.

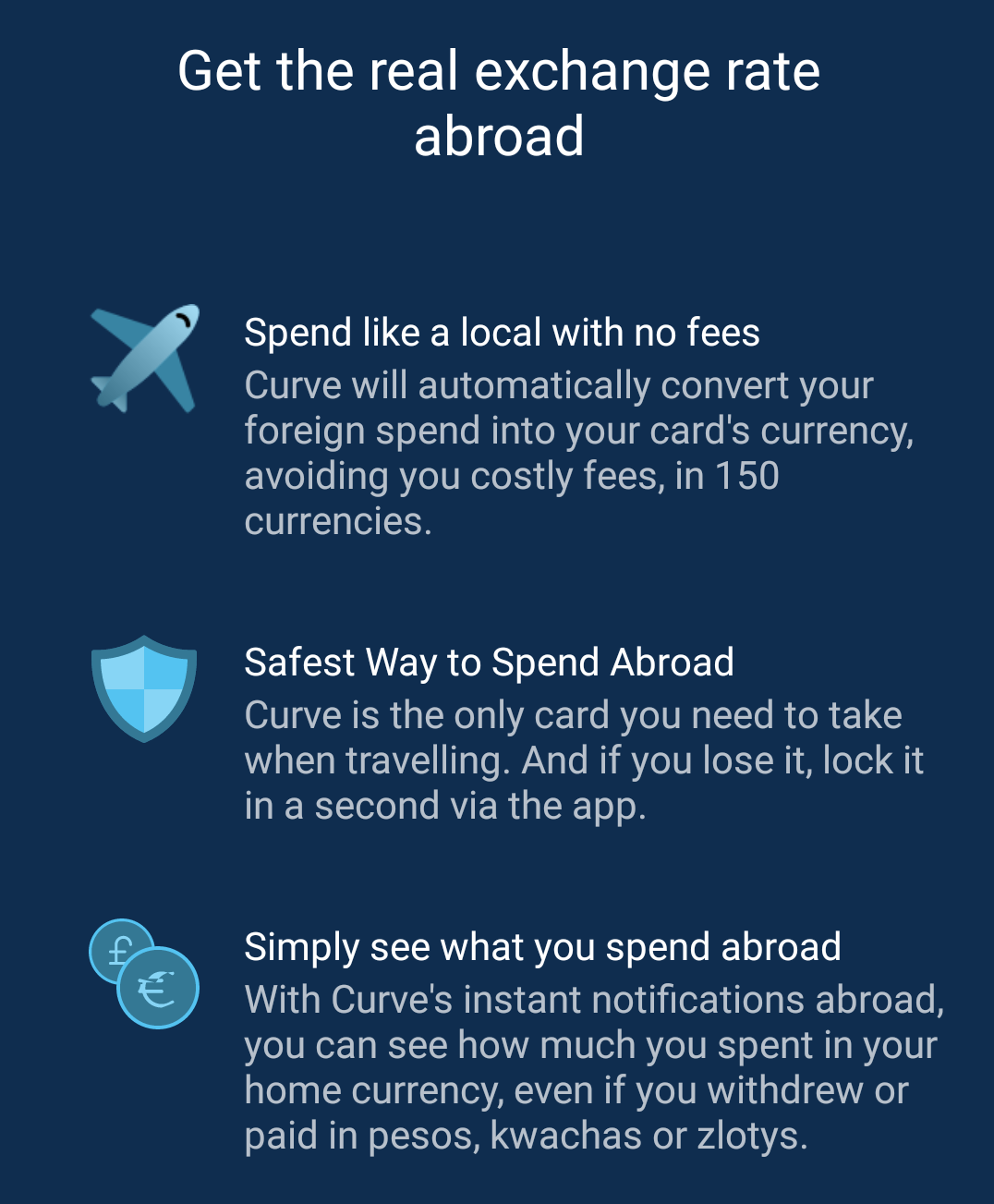

5. Paying 0% foreign exchange fee on overseas transactions, and free foreign ATM withdrawals!

It’s very, very easy to rack up extra charges when you’re travelling, and using your cards abroad can land you with a hefty exchange fee. A 0% exchange fee is fantastic, combined with the fact that you’ll only need to travel with one card instead of a wallet full.

You can also withdraw up to either £200, £400 or £600 per month fee-free from foreign ATMS (depending on your card type, see “Features section below).

It’s no wonder it’s a favourite with travel hackers.

But apart from those 5 reasons, there are a few more features that you may enjoy, and I’ve gone into those in the “how does it work?” section below.

What is Curve, and how does it work?

Curve is a mobile wallet that connects to a Mastercard debit card. By adding all of your existing debit and credit cards to it, and using Curve to make purchases, you can take advantage of a range of benefits, such as the ones I mentioned above, as well as:

- the ability to lock the card through the app if it’s lost or stolen

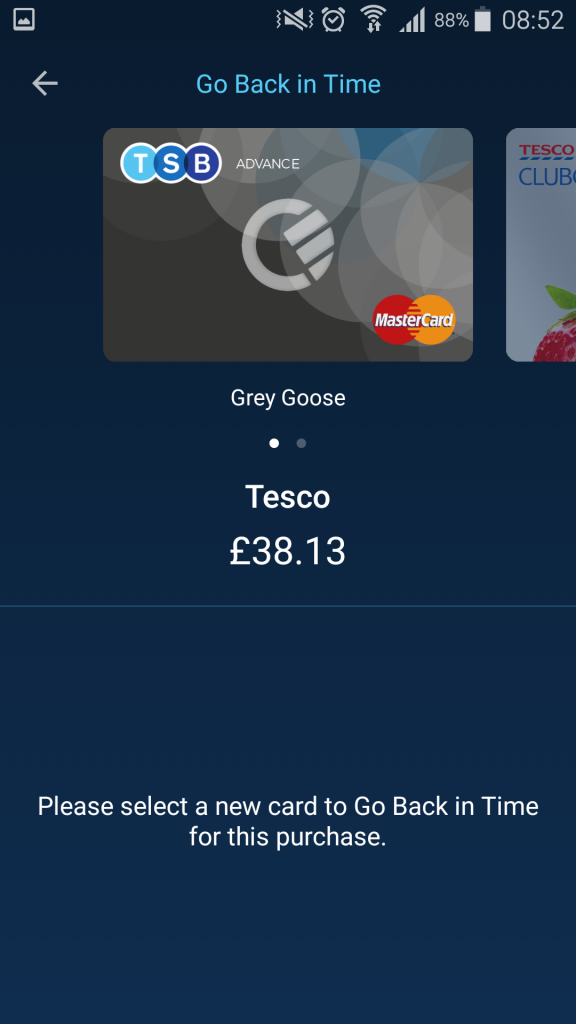

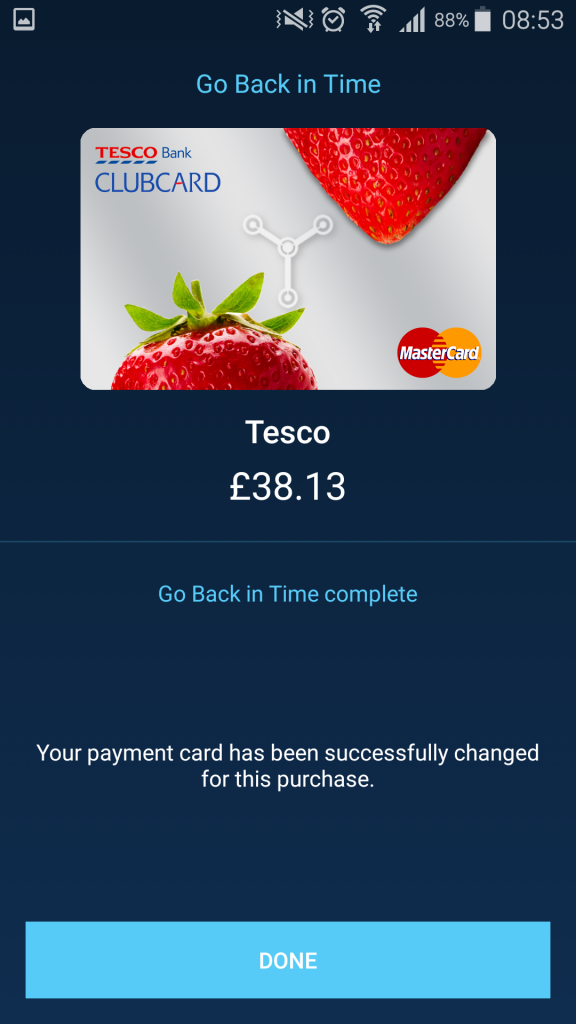

- the ability to “go back in time” and change the card you use for a transaction

The Curve Mastercard doesn’t work like a prepaid card in the sense of having to load money on to it; rather, it charges your credit or debit cards with the transactions it makes.

How much does a Curve card cost?

It’s free!

You can get all of the features I mentioned for free, or you can upgrade.

There are three options:

Curve Blue – free.

Curve Black – £9.99 per month.

Curve Metal – £14.99 per month.

About my Curve Black card…

They’re not kidding when they call it premium: the card arrived in a box that was so swish, I was a little afraid to open it in case I ruined it!

I’m an artist, but I’ll freely admit that I’m no graphic designer – it’s a very different skill set – and I’m always impressed by excellent product design. Let’s face it, the buying experience is worth something, and when I received my black Curve card and wallet, I was blown away.

You’d definitely feel pleased to receive something that has had as much thought put into it as this has.

I’d like to say that I don’t currently pay a fee for my card as I got it before the current fee structure, when the premium version required a one-off upgrade. I also received my premium account free in order to test it and review it.

Features

Insurance

Curve Black & Metal card holders get worldwide travel insurance and electronic gadget insurance through AXA.

Curve Metal card holders also get rental car collision damage waiver insurance.

Cashback

As I mentioned before, the cashback is one of my favourite features.

The free Curve Blue card will give you a choice of 3 retailers for earning cashback, but for an introductory period of 3 months.

With my Curve Black card, I’ve got a choice of 3 retailers for earning cashback. I’ve chosen Tesco, Amazon and Ikea.

If you have a Curve Metal card, you get a choice of 6 retailers for cashback.

Time travel

I added two credit cards, and after a supermarket run, I switched one of my purchases. I had actually unintentionally used the wrong card, so although I had just wanted to test this feature for this review, I ended up happy to be able to use it!

Travel perks

Besides the fee-free foreign exchange you can also get fee-free foreign ATM withdrawals.

- Curve Blue cardholders can withdraw up to £200 per month.

- Curve Black cardholders can withdraw up to £400 per month.

- Curve Metal cardholders can withdraw up to £600 per month.

As I mentioned before, there’s travel insurance and more underwritten by AXA, but there’s also the worldwide airport loungekey access… which I don’t know much about since I don’t travel much, but it sure sounds swish!

Even at the basic level, Curve is a great idea for travellers, but on the paid plans, it’s very, very handy indeed.

Is using a Curve card safe?

Anything that involves my existing credit cards has to convince me of its safety.

Curve doesn’t affect your relationship with your credit/debit card provider and you’ll still get statements from them as you normally would – the difference being, you’d see “CRV” prefacing the merchant name on your statement.

As for data security, Curve’s website states: “your data on Curve is protected with financial services industry-standard encryption and security measures.”

One thing to consider is that you won’t get Section 75 cover for purchases over £100, but you are still covered by the Mastercard chargeback scheme.

I used the app and card for a couple of weeks before writing the first version of this review, and I’ve been using it happily for a year now. A full account of their security measures can be found here.

Is a Curve card worth it?

A Curve Blue card is most definitely worth it in my opinion. As for Black and Metal, the value of these options will depend on how often you use the enhanced features.

If you don’t travel at all, then it’s unlikely you’ll really get the benefit from them. If you do travel a fair bit, you probably need something just like Curve Black, and if you travel a lot and need to do a lot of spending, then Curve Metal might just be a lifesaver for you!

How to get Curve

If Curve sounds like it’s for you, download the app and use promo code G68DX to get your free Curve card as well as a free £5 credit!

FAQs

Curve is a mobile wallet that connects to a Mastercard debit card. By adding all of your existing debit and credit cards to it, and using Curve to make purchases, you can take advantage of a range of benefits mentioned in this article.

Curve doesn’t affect your relationship with your credit/debit card provider and you’ll still get statements from them as you normally would – the difference being, you’d see “CRV” prefacing the merchant name on your statement.

Your data on Curve is protected with financial services industry-standard encryption and security measures.

There are three options:

Curve Blue – free.

Curve Black – £9.99 per month.

Curve Metal – £14.99 per month.

A Curve Blue card is most definitely worth it in my opinion. As for Blue and Metal, the value of these options will depend on how often you use the enhanced features mentioned in this article.

Use promo code G68DX when you download the app and you’ll get a free £5.