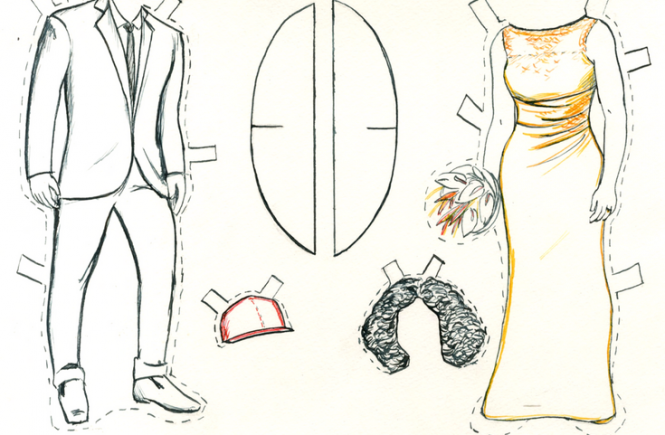

The Timeline of Your Child’s Finances

I’m pleased to present a guest post by Chris Smith. Enjoy!

So, it’s time to make the move from piggy bank to real bank. Opening a children’s savings account is one of the best ways to teach a child about money, it will also encourage them to put aside some of their pocket money or the money they receive as presents.

Children’s bank accounts

You can open most children’s bank accounts from the age of 11. Many accounts won’t have features like debit cards, instead the focus will be on how much interest the account pays.

Getting your little loved ones into the habit of saving at a young age will stand them in good stead for the future. Providing them the tools to save enough to eventually use on big expenses, such as driving lessons or their first car. Make sure you let them get involved in the process of picking their account and look through the types of accounts available together, weighing up the pros and cons of each.

Junior ISAs

An alternative to a child’s saving account is a Junior Cash ISA. One of the main considerations when comparing a normal kids’ savings account to a junior ISA is if you or they will need access to the cash. Junior ISAs lock funds away until the child turns 18 – at which point it’s their money. This obviously comes with positives and negatives. You can read more on the full ins and outs of junior ISAs here.

Student bank accounts

Once your child has graduated high school and if they have taken the decision to move on to higher education, they’ll be entitled to open a student bank account. There are many different student accounts with different deals and benefits – make sure they take the time to shop around and find the one that best fits their needs.

One of the popular features of many student accounts is the 0% interest overdraft. In a national student survey, 43% of students said they use their student overdraft as a source of income. So, with the chances of them turning to their overdraft now and again being high, it is very important they know how it works, any pitfalls and how they’ll pay it back.

If you want to help them avoid dipping into an overdraft then there are lots of budgeting tips out there to help them make the most of their finances at college or university, which could help minimise the amount of debt they leave their studies with.

Graduate accounts

Once they have graduated this can be upgraded to a graduate account which offers different rewards and incentives. It’s good to read up on what happens to a bank account after you graduate, as ultimately they’ll have to make the switch.

They will most likely receive a letter from their bank which will detail when the student account will be automatically converted into a graduate one, these accounts tend to be better than your average current account, but don’t come with as many benefits as a student account. It’s also important to remember that they don’t need to stay with the bank that they opened the student account with.

[bctt tweet=”Children’s accounts, student accounts and graduate accounts explained!” username=”homelyeconomics”]

Buying their first home

When they reach their twenties (or earlier if possible), they should be making time to build up and manage their credit score, as this will greatly impact their ability to borrow money and apply for a mortgage.

It is important for them to first understand what a credit score is, what a good score looks like and how they can work to improve theirs. There are lots of online services offering free credit score checks which is a great place to start.

Help to Buy

If buying a home is the next big thing on the horizon for your offspring then you should encourage them to save money into a Help to Buy: ISA. Saving a deposit is one of the biggest hurdles for young people looking to get on the property ladder. In response to this challenge, the government created the Help to Buy: ISA scheme, to help hard-working people save towards their first home.

First time buyers can save up to £200 a month towards their first home with the ISA and the government will boost those savings by 25%. That’s a £50 government bonus for every £200 saved, up to a maximum government bonus of £3,000.

Once the deposit is in the bag there is still so much to think about and the long journey ahead may leave many first-time buyers overwhelmed. You can help them get started on their journey by sharing them with them useful tools that will help make the process more digestible and less daunting.

Get them interested in their financial journey

Your son or daughter’s financial journey will most likely start at the age of 11. If you can give them a head start by igniting their interest in personal finance early, this will help them prepare to fly the nest and lay the foundations for a prosperous future – finding success, stability and most importantly, happiness.

2 Comments

I might add before children’s accounts you can open custodial accounts for free for your kids. Mine have had them since birth.

Thanks for adding that! 🙂